Mid Cap funds have investments in companies which are still growing and have more potential to grow. let’s start with the disclosure that the below funds are not a recommendations but the broad comparison of the funds in same category to help us shortlist the consistent funds. Selection of a fund in your portfolio is dependent on lot of other factors including your asset allocation, time horizon and risk profile.

What are Mid-cap funds? What is their risk & return profile?

As per the latest SEBI guidelines, Mid-cap funds should have a minimum investment in equity & equity related instruments of Mid-cap companies 65% of total assets. It is an open ended equity scheme investing across Top 101-250 by Market Cap. So in theory, the fund manager has the range of stocks to pick most of these stocks are well researched and followed by investing community in India. The opportunity to generate alpha against index is a possibility given lot of these stocks are in growth trajectory as well as they are not very well followed by the Large FIIs given the limited liquidity. At the same time, due to limited institutional holding the issue of corporate governance can be overlooked and can trigger more defaults.

The CAGR return for the category has been in range of 4-5% over the last 3 years given the correction in that segment since the start of 2018. Over 5 years, funds have performed decent with average returns of 9-10%. The PE valuations have corrected from the highs at the 2017 Dec levels, Though the mid-cap returns and directions are highly correlated to Nifty index as well 70-90%. If Nifty valuations stays high and earning growth does not return this will stay in the similar ranges or lower range as of today over next 1-2 years (Read: Lessons from Nifty History).

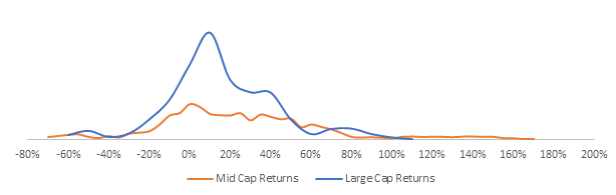

Mid-caps are always positioned as a category to generate better returns though people dis-regard the risk they comes with. Below is the chart to reflect that on average they do have a better returns but returns distribution is too wide from -70% to +165% on a one year basis vs Large cap where returns are more centralized.

Who & when should we invest in these funds?

If you have a long investment horizon (5-7 years+), and can stomach the volatility of returns then this is one of the category to look for. Please note that investing for long time horizon does not mean better returns but it means to reduce the risk of returns being negative.

Secondly these funds need to be more tactical in nature and not more than 20-25% of your core Portfolio given their higher volatility. This fund category is more to generate alpha by using them as satellite to your core portfolio, similar to small caps or sector funds. (Core & Satellite Portfolio). For core portfolio it should be Large cap, ETFs or a Multicap fund.

Which are the best funds in this category?

This is a category of funds, Some will fall in love while others will hate them to core depending on their experiences. Actively managed funds will be a better option for at least over next decade given the volumes and breadth of the stocks. Here are my picks,

- Kotak Emerging Equity

- L&T Midcap

- Franklin India Prima

- DSP MidCap

- Axis Midcap

Data is as of Aug 23th, Source: Value Research & Morning Star

Those of you who hold the funds other than suggested, if your fund is in the top 5-10 of the category you can continue to hold it or think of opting from one of the Top 5 based on your preference. Do write to us for your feedback, queries and suggestions. if you like it, don’t forget to subscribe it. Read more category reviews: Large-cap fund, Multi-cap fund, Small cap fund, Value funds

if you like it, don’t forget to click the like or subscribe it.